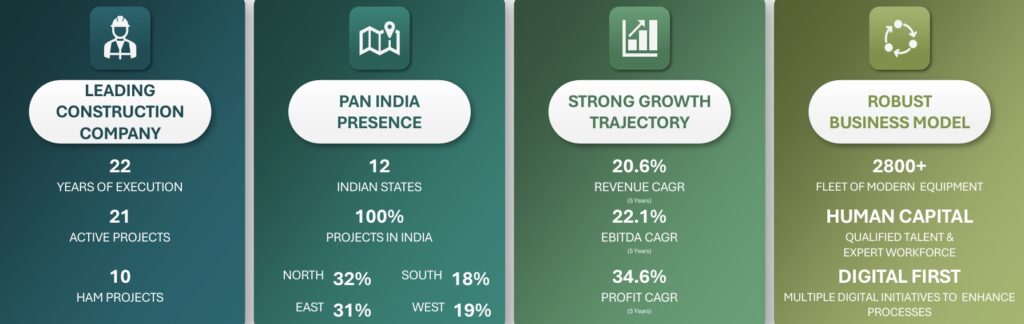

H.G. Infra Engineering Limited (HGIEL) is an Indian Road Infrastructure Company engaged in the business of Engineering, Procurement and Construction (EPC) Services, Maintenance of roads, bridges, flyovers and other infrastructure contract works. The Co is majorly engaged in road construction activities through EPC Business with selective focus on Hybrid Annuity Model (HAM) Projects. The company has recently announced that it is also entering into Solar and Green Hydrogen segments. With a government push and policy support in this segment the company is expected to create a huge wealth for its investors. Here are the key highlights of this company:

- Key Numbers and Ratios: The Current Market Price of H.G. Infra Engineering Ltd is Rs 1380 at the time of writing this article. Screener data is showing Intrinsic Value of Rs 1626 which is almost 18% more than the Current Market Price. Let’s have a look at the key numbers:

Current Price

Rs 1380

Book Value

Rs 377

Market Cap

Rs 8,991 Cr

PE

17.1

PEG

0.52

Debt to Equity

0.62

OPM

19.7%

ROCE

24.1%

ROE

24%

Current Ratio

1.55

Promoter Share

74.5%

DII Holding

12.5%

FII Holding

1.68%

Positives:

· Low Debt company with 03 years Compounded Profit Growth of 27%.

· Strong DII presence in the shareholding further boosts investor confidence.

· Strong reserves of Rs 2390 Cr against debt of only Rs 1513 Cr. However, this range of debt is a common for infra company of this size as large projects requires large amount of capital.

· Strong Order book of 1,24,340 Cr and the healthy increase in order book is seen with a CAGR of 14.9% in the order book growth segment. Here is a snapshot of the company order book:

· Strong five-year Revenue Growth of 20.6%, let’s have a look at the last five-year data:

· The current Debt to Equity ratio of HGIEL is 0.62 and it is decreasing with every passing year, which indicates the strong fundamentals of the company. Let’s have a look:

· The Profit After Tax (PAT) showed a healthy CAGR of 34.6% which is impressive and EBITDA also have shown a CAGR of 22.1%. Let’s have a look at this impressive numbers:

Negatives: The majority of the key numbers are in a super-healthy state and if you analyse the available data you will not find any significant cons related to this company.

Promoters and Management:

Company is run by Promoters with impressive track record and timely completion of the projects with 100%project completion rate boosts confidence in the management and the future

prospects of the company.

Challenges:

While they say that the coming decade belongs to India, yet there are many challenges which can affect any infra company on their journey to success. These challenges may come in the form of Regulatory Approvals, or in the form of Policy and Governance Challenges, as lack of clarity in the policy and delay in regulatory approvals can take off any good company off the track at any time. Investors need to keep them updated about the various policy changes which can affect these businesses in a bad way.

Growth prospects and future outlook:

Hg Infra is well-positioned to take advantage of growing prospects thanks to the government’s unwavering commitment to supporting infrastructure development through programs like the National Infrastructure Pipeline (NIP) and the Bharatmala Project.

Multibagger takeaway:

HG Infra Engineering Ltd. can be the leading player in contribution towards the advancement of the country. As India sets out on its path towards infrastructure change in India, this business is one of the industry leaders in its particular niche, investors should do research for these types of opportunities.

Disclaimer: We are not a SEBI registered analyst, please do your own research and consult your financial advisor before taking any investment decision. Indianmultibaggers will not be responsible for any loss in future. The prices and data may vary according to the market forces at the time of reading this article.

Great learning