Company Overview:

The company was incorporated in 1995 and it is a Hyderabad-based infrastructure project development company providing (Engineering Procurement and Construction) EPC services in segments such as roads and highways, irrigation and urban water infrastructure management. The company name is KNR Constructions Ltd, let us read more about this company:

Services:

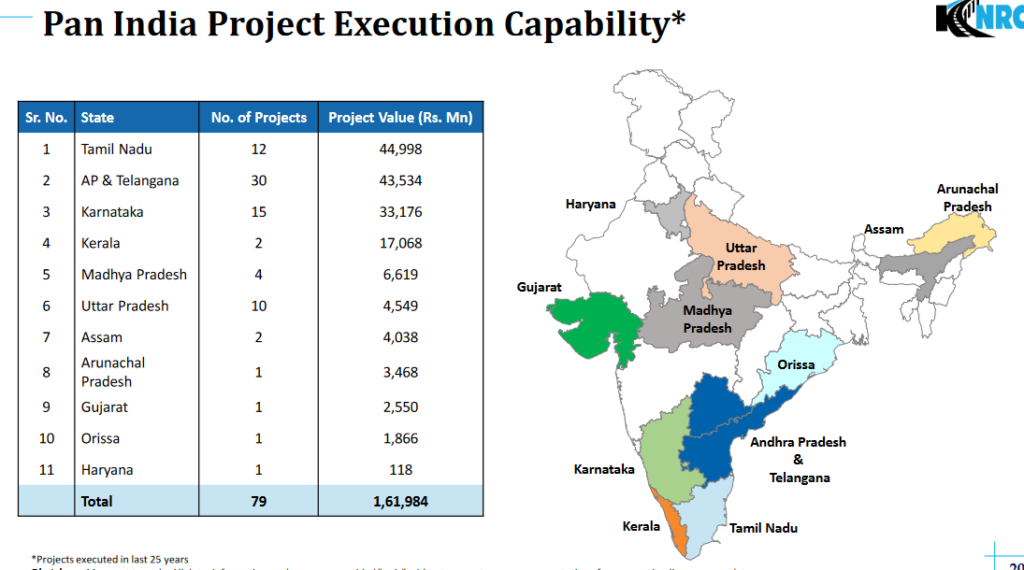

The KNR Constructions is one of the major players in EPC services which also undertakes projects under HAM (Hybrid Annuity Model) / BOT (Build, Operated and Transfer) model. The company works mainly in two segments in EPC segment which are Roads sector and Irrigation and Pipeline sector. The company has 25 years of experience and has completed around 8700km lane of projects across the 12 states of India. Let us have a look:

Key metrics: Let’s have a look at the main key metrics of the company:

Current Price | Rs 318 |

Market Cap | Rs 8940 Cr |

PE | 11.9 |

PEG | 0.50 |

Debt to Equity | 0.36 |

Operating Profit Margin | 23.6% |

Book Value | Rs 126 |

Promoter Shareholding | 51.1% |

DII Holding | 30.5% |

FII Holding | 7.13% |

Technical analysis:

After a long period of consolidation, the stock has given a breakout above the trend-line of around 2 years, supported by large volume candle as evident in chart. The stock now seems ready to fly, backed by strong results and positive scenarios building up in the Indian markets due to the market optimism. Let us have a look at the chart:

Let us have a look at the consolidated results and major highlights:

F24 Financial Highlights:

► YoY Revenue growth :14%

► YoY EBIDTA growth :52%

► YoY PAT growth :140%

► YoY EPS growth :70%

Q4 Financial Highlights:

► QoQ revenue growth :42%

► QoQ EBIDTA growth :66%

► QoQ PAT growth :151%

► QoQ EPS growth :153%

Clients:

Being the leading player in the industry, they boast of strong client network across the India, let’s have a look:

Positives:

► Company has delivered good profit growth of 33% CAGR over last 3 years

► 3 Year ROE of 19%

► Better than industry average Operating Profit Margin of 24%.

► Net Profit Increased from 439 Cr (LY) to 752 Cr this year.

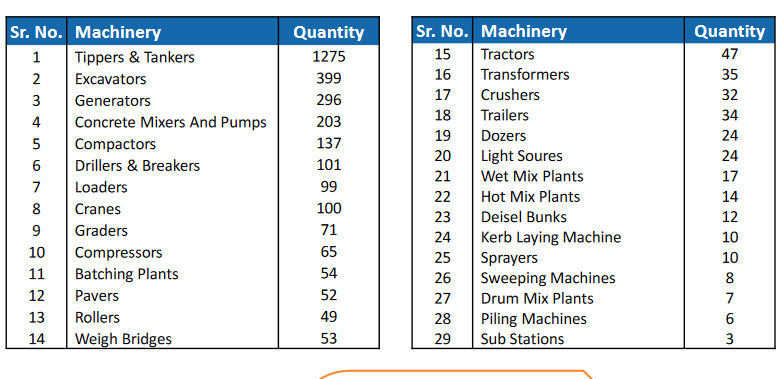

► The Gross Block of Plant and Machinery is around Rs 145 Cr. Lets have a look at the plant and machinery of the company:

Negatives:

► No significant negatives.

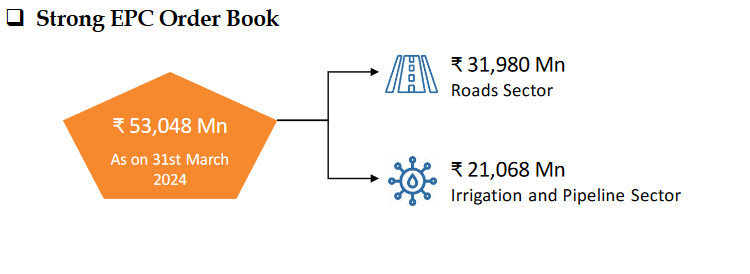

Order Book:

The company has a strong order book both in Roads and Irrigation and Pipeline sector, let us have a look:

Future Prospects:

KNR Constructions Ltd has solidified its reputation as a reliable infrastructure project development company, particularly in the EPC sector covering roads and highways, irrigation, and urban water infrastructure management. With India’s ongoing emphasis on enhancing its infrastructure, the company is well-positioned to benefit from numerous government initiatives aimed at expanding and modernizing transportation and water management systems. Additionally, KNR’s extensive experience and proven track record in delivering complex projects on time and within budget enhance its competitive edge.

The Multibagger takeaway:

As urbanization and economic growth drive the demand for improved infrastructure, this coupled with government push towards infra growth, supported by government spending on infrastructure heavily, KNR Constructions Ltd is likely to be the major beneficiary of this sustained growth. Companies focus on innovation, quality, and expanding its project portfolio across various high-potential sectors will definitely create wealth for the investors.

The company has a healthy balance sheet and the performance and growth of the company indicates the strong execution capabilities of the company in this sector. Investors can look for such opportunities in the market to create a strong portfolio.

Disclaimer:

We are not a SEBI registered analyst, IndianMultibaggers will not be responsible for any loss in future. Please do your own research and consult your financial advisor before taking any investment decision. The prices and data may vary according to the market forces at the time of reading this article. Users are advised to also read the underlined back-linked terms for learning and understanding the markets.

Index to links:

- https://www.screener.in/company/KNRCON/consolidated/

- https://in.tradingview.com/chart/VYFq1Yeh/?symbol=NSE%3AKNRCON

- https://www.bseindia.com/xml-data/corpfiling/AttachHis/1daa8185-b02c-4736-8cc5-0676d482aea4.pdf

- https://www.researchgate.net/publication/269401359_A_Study_of_Fundamental_Analysis_of_Infrastructure_Industry_in_India

- https://www.iasgyan.in/blogs/forms-of-projects-modes-of-construction