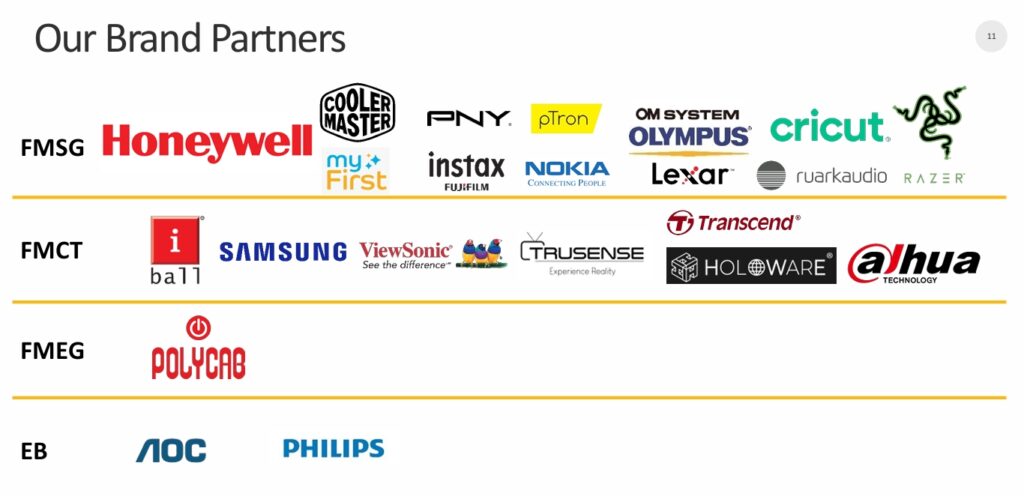

Company Overview: It is a distribution and marketing partner of Global IT, Imaging and Lifestyle brands catering to their distribution requirements through its omni-channel presence. The Co entered into a contract manufacturing and distribution agreement with Honeywell in 2016 across multiple product segments. This involves manufacturing products at Honeywell certified factories, Designing and packing of products as per Honeywell global packing guidelines and distribution in SAARC, Middle East and APAC countries. The contract has been extended by five years during FY21. Let us look at the Product Portfolio:

IT/Gaming Products: The Co offers a range of IT hardware products like printers, supplies (cartridges), PC components (monitors, hard disks, SSDs, graphics card, RAMs, Memory Card, High end gaming accessories), and storage devices offered by multiple vendors.

Imaging: Large range of cameras, tripods and other imaging products.

Lifestyle and security: This segment includes products such as TVs, headphones, projectors, grooming products and other lifestyle products and IT accessories.

Clients: The company name is Creative Newtech Ltd. caters to the distribution requirements of a number of globally renowned brands, let’s have look:

Chart Analysis: At the time of writing this article the stock is consolidating at a price of Rs 781. The price broke above one-year resistance of 746 and currently consolidating in the same zone. This huge consolidation is supported by the volume as indicated by the huge volume candles below. Let’s have a look at the chart of stock,

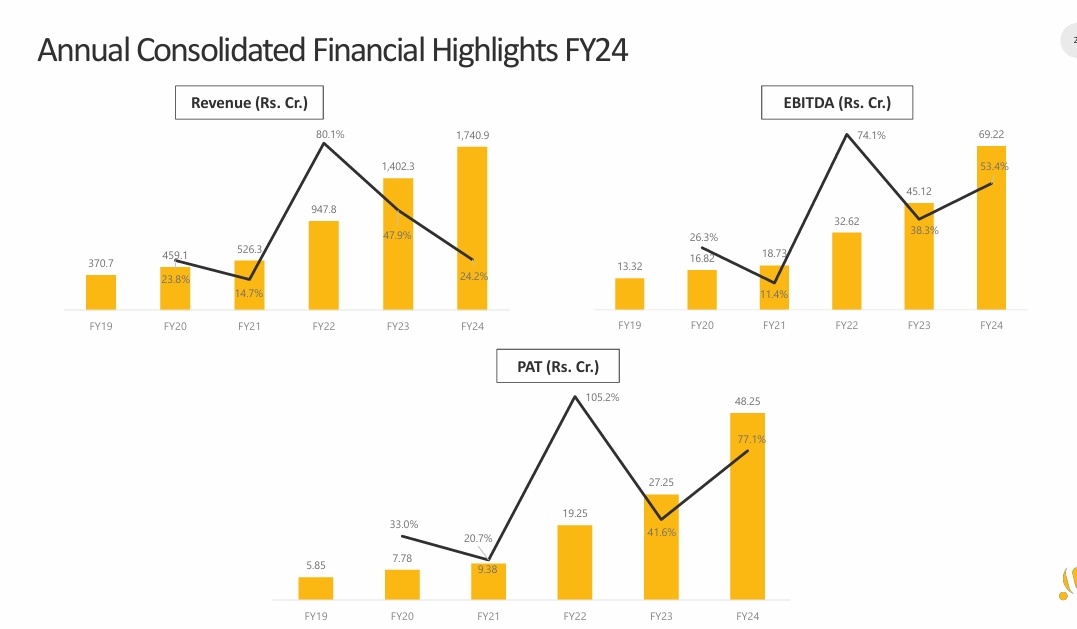

Financial Highlights:

YoY revenue growth: 24%

YoY EBIDTA growth: 53%

YoY PAT growth: 77%

Have a look at the Revenue, EBITDA and PAT growth trend from last few years:

Key metrics: Let’s have a look at the main key metrics of the company:

|

Current Price |

Rs 781 |

|

Market Cap |

Rs 1103 Cr |

|

PE |

22.8 |

|

PEG |

0.44 |

|

Debt to Equity |

0.34 |

|

Operating Profit Margin |

2.42% |

|

Book Value |

Rs 146 |

|

Promoter Shareholding |

56.7% |

|

DII Holding |

1.58% |

|

FII Holding |

0.07% |

The company has showed a decent ROE of 29% and ROCE of 24 % in last FY.

High Entry barriers in this business is another breakthrough for the company.

EPS increased from 19.52 (FY 2022-23) to 34.19 in the FY-2023-24.

Compounded profit growth rate of 53% in last 5 years.

Negatives:

Company has very low Operating Profit Margin of 2.42%, and company need to improve on this area.

Future Prospects: The company has exclusive trademark license of Honeywell with right to sale in over 38 countries. The company is looking for a two-fold expansion with addition of new product categories and looking for new markets in new geographies.

The Multibagger takeaway:

Creative Newtech Ltd, started as a distribution company and from this humble beginning to its current standing as a considerable force in the technology sector. The company has continuously reinvented itself to meet the changing demands and management is positive on the future outlook of the company.

The company is showing a good strength in its financial statements as well as the management commentary. Investors must look for these types of opportunities in market to multiply their wealth.

Disclaimer: We are not a SEBI registered analyst, please do your own research and consult your financial advisor before taking any investment decision.

Indianmultibaggers will not be responsible for any loss in future. The prices and data may vary according to the market forces at the time of reading this article.