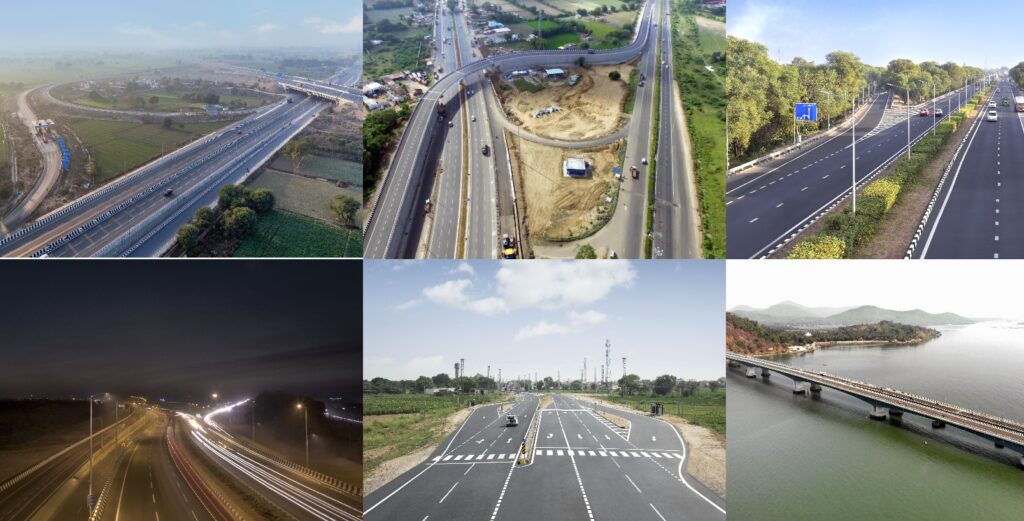

In India’s economic development, infrastructure will play a important role. It serves as the backbone, facilitating the movement of goods and people, fostering commerce, and bolstering economic growth. Within this landscape, IRB Infrastructure stands as a notable player, contributing significantly to the nation’s infrastructural advancements.

Company Overview:

IRB Infrastructure Developers Limited, commonly known as IRB Infra, is one of India’s leading infrastructure development and construction companies. Specializing in roads and highways, the company has made remarkable strides since its inception. With a focus on innovation, efficiency, and sustainability, IRB Infra has garnered attention both domestically and internationally. The shares of the company are also held by various mutual funds in this segment. Groww Nifty Small Cap 250 and Motilal Oswal Nifty 500 ETF are the few mentions.

Financial Snapshot:

Before going in detail, let’s have a look at IRB Infra’s various basic financial parameters:

|

Current Price |

Rs 68.4 |

|

Market Cap |

Rs 41, 295 Cr |

|

PE |

68.2 |

|

Debt to Equity |

1.36 |

|

Operating Profit Margin |

40.7% |

|

Order Book |

₹36,185 cr as of December 2023 |

|

Promoter Shareholding |

34.4% |

|

DII Holding |

7.78% |

|

FII Holding |

47.2% |

Recent Results:

As per recent IRB press release, Q4FY24 PAT is at Rs. 189 Crs; Consolidated Income Rs. 2,504 Crs which is growth 45% and 47% respectively. The Toll Revenue Collection of the IRB infra has also grown by 22% to 503 Cr in April 24. The sales grew from 1969 Cr in the last quarter to 2061 Cr in the quarter ending April 24 and when looked by YoY basis the sales increased from 6402 Cr to 7409 Cr which is a growth of almost 16 % on yearly basis. IRB Infra’s recent financial results reflect its resilience and adaptability in a dynamic economic environment. The company has demonstrated robustness in its operations, showcasing steady growth and prudent financial management.

Future Prospects:

The future appears promising for IRB Infra, aligning with India’s ambitious infrastructural goals. With the government’s steadfast commitment to bolstering infrastructural development through initiatives like the National Infrastructure Pipeline (NIP) and the Bharatmala Project, IRB Infra is well-positioned to capitalize on burgeoning opportunities.

Management and Vision:

Sudhir Rao Hoshing, is the CEO of IRB infra. A civil engineer by profession, he has more than 36 years of experience and fully understands the type of commitment and effort needed to head a successful company. So, it is no surprise that his role as CEO of IRB Infrastructure spearheading the company towards greater heights. He says,

Success is measured by how you run the show, how confident your people are in you, how happy your stakeholders are with you and how the company is growing.

His strategic foresight, coupled with a relentless pursuit of excellence, underscores IRB Infra’s commitment to delivering value to its stakeholders. When you visit the IRB infra’s website, it resonates with confidence, outlining a bold vision for the future and emphasizing its unwavering dedication to quality, sustainability, and innovation.

Multibagger takeaway:

As India embarks on its journey towards infrastructural transformation, IRB Infrastructure stands as a beacon of nation’s progress. Investors can look for the opportunity in this company as it is among the market leaders in their segment. Though valuations may look little stretched investors can wait for their opportunity in the times of correction and can take position with a buy on dip strategy.

Disclaimer: We are not a SEBI registered research analyst, please do your own research and consult your financial advisor before taking any investment decision. The prices and data may vary according to the market forces at the time of reading this article.