About the business:

Selan Exploration Technology Limited is a leading private sector listed company engaged in Oil & Gas Exploration and Production (E&P) since 1992. It is one of the pioneers in the Indian E&P sector, the company was among the first private sector entities to obtain rights for developing discovered oilfields in Gujarat after the Government of India opened the sector to private players in 1992.

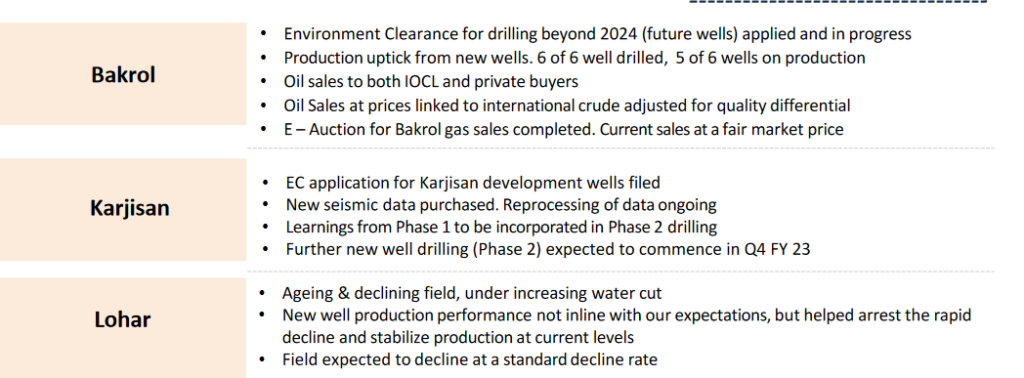

At present, the company holds a portfolio of three Oil and Gas fields, namely Bakrol, Lohar, and Karjisan, located in the Indian state of Gujarat. Selan is amongst the first private sector companies to secure development rights for three dicovered oilfields in Gujarat: Bakrol, Lohar, and Karjisan, all with proven oil and gas reserves.

Key Financial Metrics:

Let’s have a look at the main key metrics of the company:

► Current Price : Rs 893

► Market Cap : Rs 1358 Cr

► PE : 29.6

► Debt to Equity : 0.01

► LY Operating Profit Margin : 28%

► Book Value : 259

► Promoter Shareholding : 30.5%

► DII Holding : 0.12 %

► FII Holding : 5.02 %

Recent important developments:

- One of the Oil fields of the company which is Bakrol Field has been awarded in “Exemplary Performance in Asset/Block” category in “UrjaVarta 2024”, by the Directorate General of Hydrocarbons,

- Q1 FY’25 Sales at c. 1100 boepd (c. 12% q-o-q increase in sales).

- Received regulatory approval for transfer of 50% Participating Interest and Operatorship to Selan for the new Cambay Field. Company in their latest investor presentation said that further takeover of operations and firm-up on the detailed work program is under progress.

- One more field Duarmara Field is under development and is expected to be completed in FY 25.

- Star Investor Dolly Khanna has recently acquired 1.56% stake.

- A full fledged operational Crude Processing Facility has been put in place to cater to existing and future production from Karjisan wells.

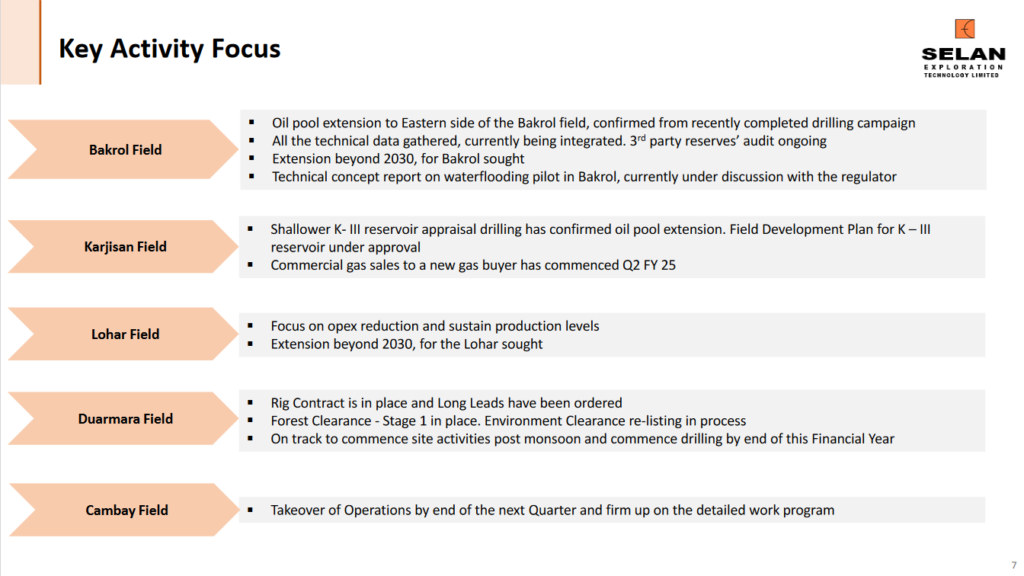

- Here is a snapshot of the company presentation highlighting the key focus areas of the company in the coming times:

Management Vision and plans:

- Primary focus on responsible & sustainable growth thereby augmenting stakeholder value – focus to be resilient through the commodity price cycles.

- Leverage on decades of deep technical experience of the team to unlock the hidden value in the discovered Oil and Gas reservoirs.

- Infuse best in class technology and speed of execution to deliver on our business plans.

- Keeping our workforce safe, minimizing our environmental impact, partnering with and investing in local communities.

How Selan can be a possible multibagger bet?

- New Drilling Operations: For the FY 2024-25, the company is progressing with the 11 new wells, out of these 11, 6 are in BAKROL, one in LOHAR, four in KARJISAN. Out of these 11, production has started on the Q1 FY 24-25 and production in the remaining four wells will commence in the Q2 of the current FY. All the execution timelines are being met by the company and this speaks of their technical know-how and pedigree.

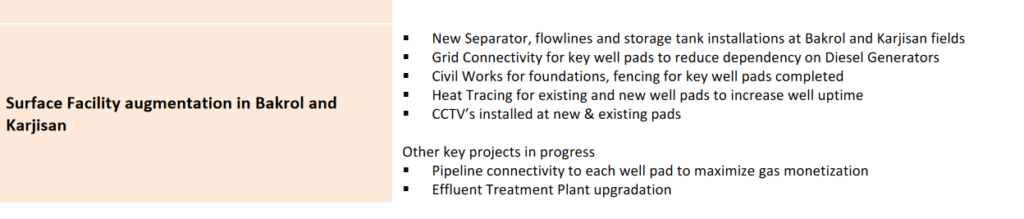

- Infrastructure Augumentation: The company has entered into 10+ new long term land lease agreements over the last one year in Bakrol, for future development of drilling & potential secondary recovery implementation (water flooding). Here is the snapshot of the surface facility augmentation at BAKROL and the other infrastructure up-gradations:

Financial Performance:

Let us decode the historical financial performance of the company and how the financial data is indicating at the possible good future of the company:

- The company has clocked the sales of 201Cr in the Trailing Ten Months (TTM). Which is up by 21% from the previous year. The company has recorded best ever June quarter till date with a sales of 63Cr.

- 3Y Compounded sales growth is 50%.

- 3Y Compounded profit growth is 114%.

- Fixed asset base of the company grew from 179 Cr in the FY 23 to a whooping 300 Cr. Our of these 300 cr, 279 Cr of Capital Work is under progress and given the past performance of the company, it poised to push the performance of the company to a new heights.

- The Working Capital Cycle of the company has reduced to 65 days only.

- FIIs and DIIs has been consistently increasing stake in the company. Also, the entrance of many big individual investors further boosts confidence in the company.

Risk factors:

No business is without any risks and the company is into the oil exploration business which requires a very advanced technical prowess. Though they are the one of the earliest private players in the business, but still working in the sea is subjected to many unknown risks. Any untoward ,incident may tarnish the image of the company, although the company has invested heavily in mitigating the risk factors associated with the sea drilling operations. Safety of its workforce is also a highlighted priority in the company investor presentation. Also any unexpected geopolitical tension may hamper the execution plans of the company in particular and nation as a whole.

The Multibagger takeaway:

The business of the company is in line with the growing energy demands of the emerging nation. The company has been majorly successful in its operations in past and is currently exploiting the three major fields with a total acreage of around 50 acres. The demand for the energy and power is only going to increase in the future. The company has been spending very much in enhancing their capabilities as well as for the exploration and exploitation of yet undiscovered new beds, which is the most important for the growth of any company. Considering the positive environment in which we currently are in, Selan exploration can definitely be tracked as a potential multibagger.