Company Overview:

Megatherm deals in Metal Heating & Melting Equipment and possesses the strength to meet Thermal Challenges through Induction. Incorporated in 1989, today, Megatherm has a diverse product portfolio is recognized and preferred by its ever-extending list of domestic and international clientele. With over 3000+ installations are spread over 55 countries around the globe. As per the geography contribution, the company is doing the 21% business globally and 79 % is coming from the domestic market.

How they are different?

Megatherm claims to be different from other manufacturers primarily due to product innovation & continuous R&D. As per the management, over the years they have led the way for most major design changes and additions to induction technologies which was later incorporated by the industry. They are focussed in research and have developed the systems with the best contemporary technologies that ensure optimum utility and comprehensive productivity, which is also evident from their financial performance and the large client base.

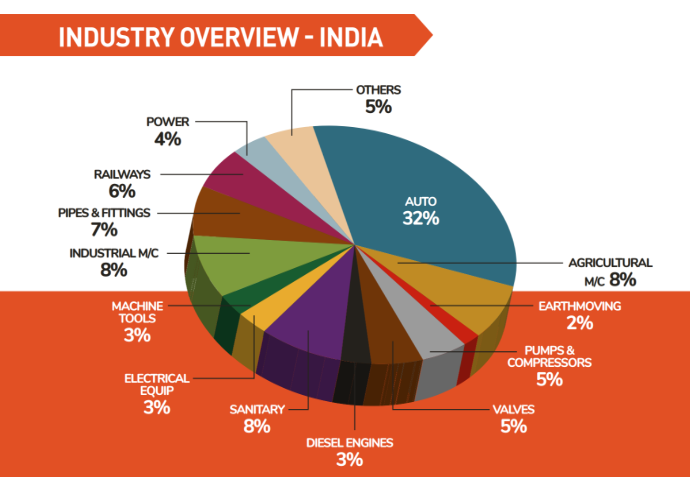

Overview of Indian Foundry Industry application in other industries:

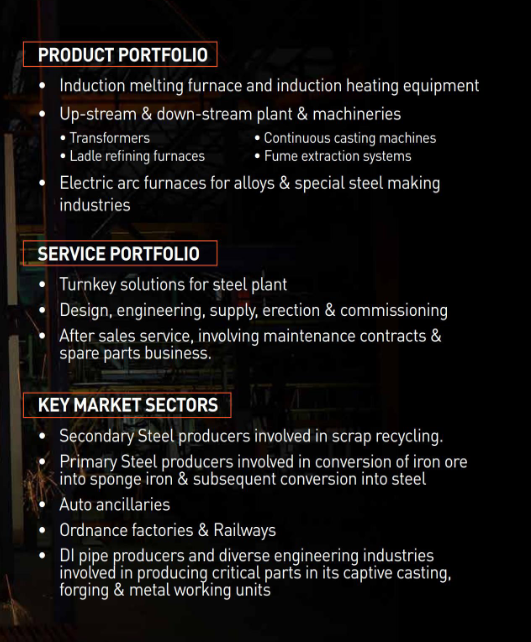

Products/ Services/ Sectors:

The products and services offfered by Megatherm Induction Ltd has a wide range of applications in multiple industries ranging from Power, Railways, Pipes and Fittings, Infrastructure, Machine tools, Agriculture, Pumps and Compressors, Electrical Equipment etc. Most of these sectors has secotral tailwinds supported by government push in irrigation, manufacturing, railways, power etc.

Key metrics: Let’s have a look at the main key metrics of the company:

|

Current Price |

Rs 463 |

|

Market Cap |

Rs 873Cr |

|

PE |

42.1 |

|

PEG |

— |

|

Debt to Equity |

0.30 |

|

Operating Profit Margin |

11.8% |

|

Book Value |

Rs 63.9 |

|

Promoter Shareholding |

72.7% |

|

DII Holding |

1.13% |

|

FII Holding |

1.80% |

F 23-24 Financial Highlights:

► YoY Revenue growth :15%

► YoY EBIDTA growth :35%

► YoY PAT growth :1172%

► YoY EPS growth :50%

Clients:

Let us have a look at the some of the esteemed domestic clients of the company:

Growth and Expansion plans:

Positives:

► 3Y Compounded sales growth of 41%.

► 3Y Compounded profit growth of 89%.

► Global presence across the 52+ countries.

► Inhouse Engineers training and R&D facility.

►Positive and consistent Free Cash flow generation from the operations.

Negatives:

► The significant negatives.

Current Issues of the steel industry:

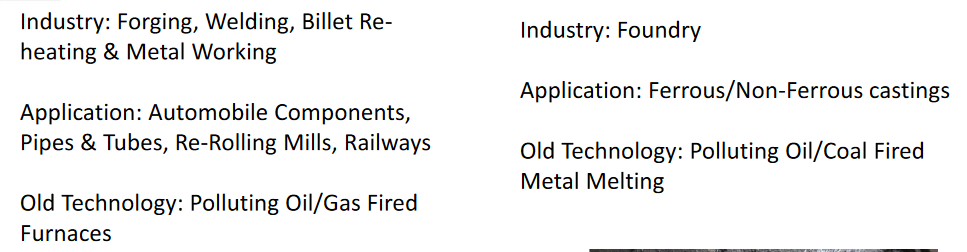

Solutions offered by Megatherm:

► Induction heating equipments.

► Induction melting furnaces for foundries.

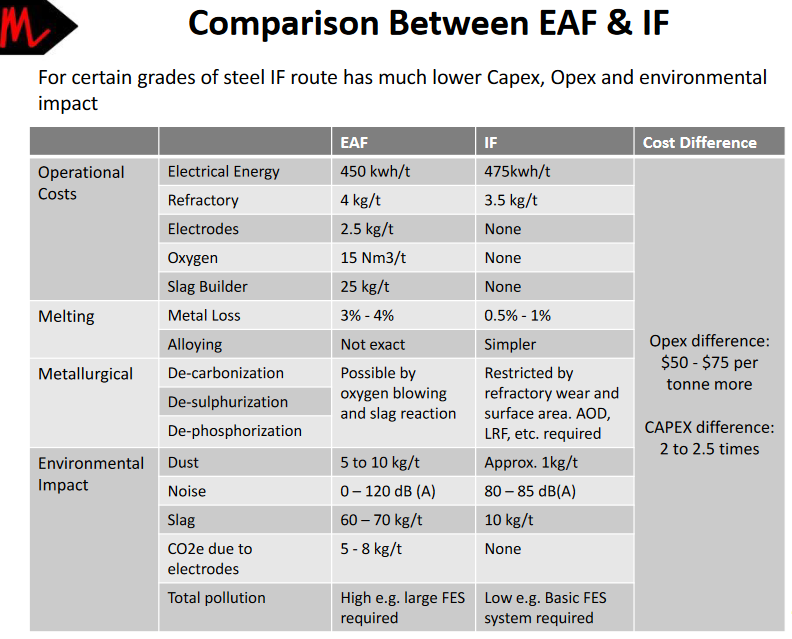

► Induction Furnace route steel melting has a lot of advantage over Electric Arc Furnace such as Low Capex (Capital Expenditure), Opex (Operating Expediture) and less environmental impact. Let us look at the comparison between EAF and IF:

Management:

The company has very honest and experienced promoters with over 45 years of experience in this industry. The management to planning to increase its global presence with sales/ services offices in UAE and Africa. Also the company is in the process to tap the North American and USA market, as these geographies provides the better profits and operating margins. Let us have a look at the top management of the company:

Future Prospects:

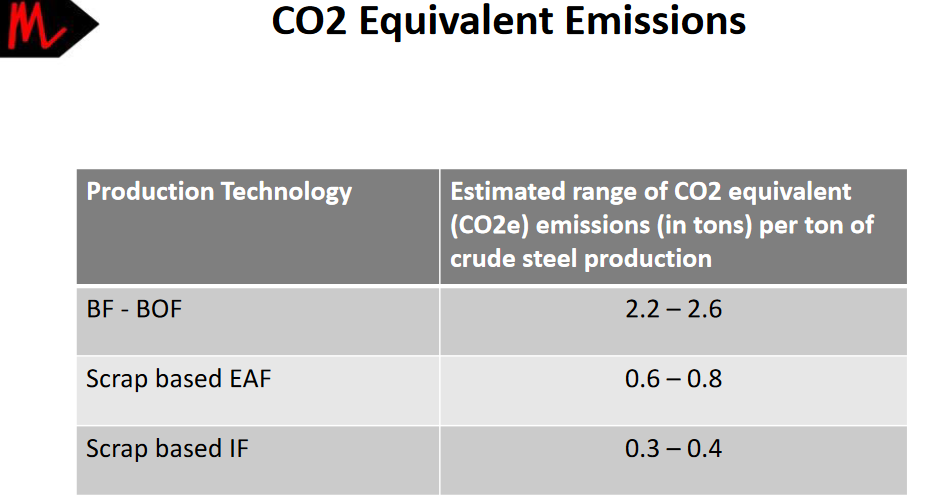

► Aligned with future trends due to low environmental impact of Induction heating furnaces as compared to the coal polluted furnaces. Let us have a look at the CO2 emission levels of Induction Furnace process w.r.t. other industries:

► Due to increasing demand of Power in the Indian Economy which is derived by the fast-economic growth. This coupled with other factors such as electrification of the transport and the heating equipment is pushing the growth in this industry.

Challenges:

The company uses various Raw Materials such as CRNG (Cold Rolled Non-Grain-Oriented Steel) and other steels and structures, Copper as the major raw materials, price and other industry variants in these commodities may affect the financial performance of the company in future.

The Multibagger takeaway:

India is very well aligned and poised to be the next manufacturing hub after China due to many global post Covid challenges. With the increasing confidence in India the world is looking to invest in India due to its fast growth as well the increasing trust amongst the global businesses.

As we seek to reduce their carbon footprint, the application of the Induction route in the Steel and metal recycling industry will have a greater demand in the future. Due to the low carbon impact of the technologies offered by the Megatherm Inducton Ltd, the application will grow the both top and bottom-line of the company. Megatherm Induction being a SME company at this point of time has a huge room for growth. Investors can track and invest in this company to participate in growth of this industry.

Disclaimer:

We are not a SEBI registered analyst, IndianMultibaggers will not be responsible for any loss in future. Please do your own research and consult your financial advisor before taking any investment decision. The prices and data may vary according to the market forces at the time of reading this article.