Company Overview:

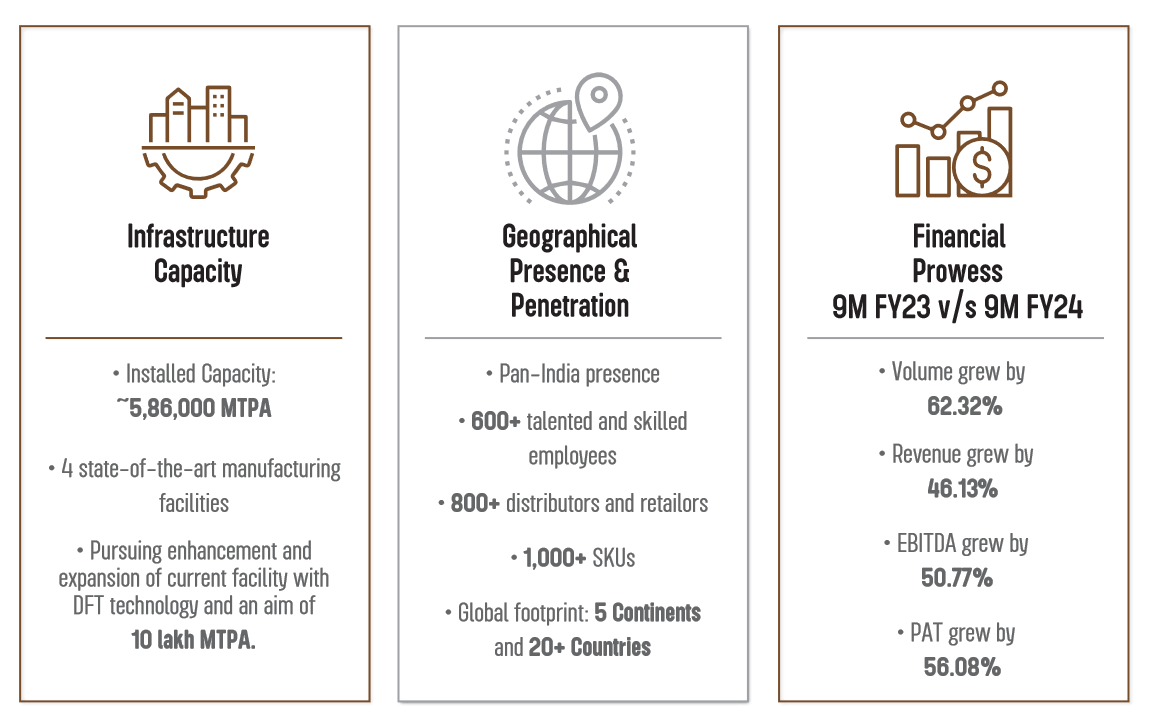

It is the flagship company of the Jagan Group of Companies, with its corporate office located in Chandigarh and four plants located pan – India. With four state-of-the-art facilities, they have a total manufacturing capacity of 5,86,000 MTPA, serving PAN India and over 20 countries across five continents. The company name is JTL Industries Limited (formerly known as JTL Infra Limited).

India Steel Pipes and Steel Tubes Market can be bifurcated in major two segments:

►By Technology: Seamless, Electric Resistance Welded, Submerged Arc Welded

►By Application: Oil & Gas, Chemicals & Petrochemicals, Automotive & Transportation, Mechanical Engineering, Power Plant, Construction

Industry Overview:

India Steel Pipes and Steel Tubes Market size was estimated at USD 32.88 billion in 2023. During the forecast period between 2024 and 2030, the India Steel Pipes and Steel Tubes Market size is projected to grow at a CAGR of 6.43% reaching a value of USD 37.69 billion by 2030. JTL industry is expanding into almost all these areas with a significant market share.

Growth drivers:

► Growing demand for oil & gas (Highest share).

► Increased need for steel pipes worldwide.

► Resurgence in construction activities.

► Thriving transportation sector

► Stringent environmental regulations.

JTL Industries products:

►JTL Ms Structura Pipe: Rectangular tubes that have high durability, malleability, and ductility, JTL Ms Structura Pipe can help reduce the material costs and the self-weight of the structures they support.

► JTL Jumbo: A premium brand of long square and rectangular black hollow section pipes that are ideal for various construction and engineering projects. It has applications in houses, buildings, furniture and industrial equipment.

► JTL Ultra: JTL Ultra GI pipes are essential components of any Ultra structure or formwork that support workers who need to work at heights or in hard-to-reach places. They are usually made of steel and have joints or fittings that allow them to connect with each other and form a stable framework.

► JTL JAL JAAN: JTL Jal Jaan is a product that offers high-quality water GI pipes that are suitable for various applications. These pipes are made of galvanized iron and have a smooth inner surface that ensures uninterrupted water flow. JTL Jal Jaan pipes are also resistant to corrosion, rust, and leakage, making them durable and reliable.

► JTL GALVA flow is versatile product that can be used in various industries that need high-quality and corrosion-resistant steel pipes. With various applications in the construction, automotive, and electrical industries. It has a wide used in refineries.

► JTL Surya Kiran and Solar Module Mounting structures:It includes rooftop solar system that enables factories and commercial buildings to harness solar energy for their power needs. It uses steel structures to mount the solar panels, which are connected to a grid-tie inverter. This way, the power generated can be used for both administrative and manufacturing purposes, reducing the dependence on the common grid. Another addition to this Solar Module Mounting structures that provides ready made frame work for the installation of solar PV panels.

JTL road guard:JTL road guard, is a state-of-the-art road safety barrier that is designed to protect vehicles from roadside hazards and redirect them safely back to the road.

Key metrics: Let’s have a look at the main key metrics of the company:

► Current Price : Rs 215

► Market Cap : Rs 3999 Cr

► PE : 33.9

► PEG : 0.67

► Debt to Equity : 0.03

► Operating Profit Margin : 7.62%

► Book Value : 45.2

► Promoter Shareholding : 50.2%

► DII Holding : 1.94%

► FII Holding : 10.1%

Financial Highlights:

► 3Y Compounded Revenue growth :67%

► 3Y Compounded Profit growth :78%

► 3Y ROE :26%

► 3Y ROCE :34%

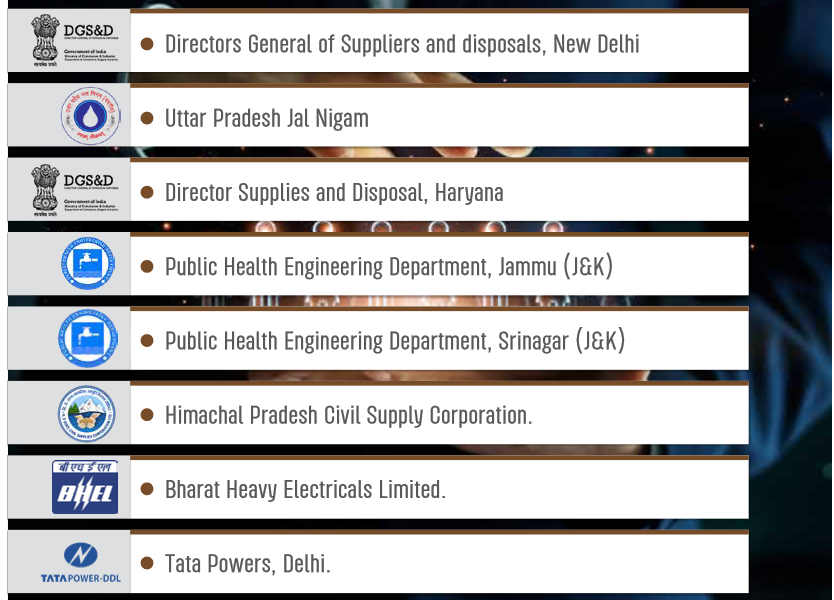

Clients:

JTL industries has a strong client base, which includes big names like TATA Power, Swaraj, ABB, Siemens etc.Let us have a look at the some of the esteemed clients of the company:

Growth Opportunities:

► Warehousing: According to IBEF, the Indian warehousing market is set to grow at a CAGR of 15.64% to $34.99 bn by 2027.

► Metro: The government plans to expand its total metro network to 2,660 km from present 690km by expanding the network in exiting cities and introducing the metro in new cities. This will create a lucrative opportunity for ERW pipes, as metro networks have a high density of stations where these pipes can be used in plenty.

► Airports: Government of India plans to build over 70-80 airports by 2025 under its Udaan Scheme. For this AAI and the private sector will invest Rs 1 trillion in the next 2-3 years for this expansion.

► Jal Jeevan Mission: Government allotted Rs. 70,000 crores towards Jal Jeevan Mission which aims to provide clean drinking water to over 180 million rural households by 2024.

► Affordable Housing: For FY24, the Government of India has enhanced their total budgeted allocation for PMAY by 66% to Rs. 796 billion. Under PMAY, Government has a task of completing 4.5 million households, which will continue to drive demand for the next 3-4 years.

► Indian Railways: Government plans to modernise & upgrade as many as 1,275 railway stations under ‘Amrit Bharat Station’ Scheme. To support this, In its last budget, the Indian Railways increased its total capex for upgradation by 240% yoy to Rs 130 billion.

Positives:

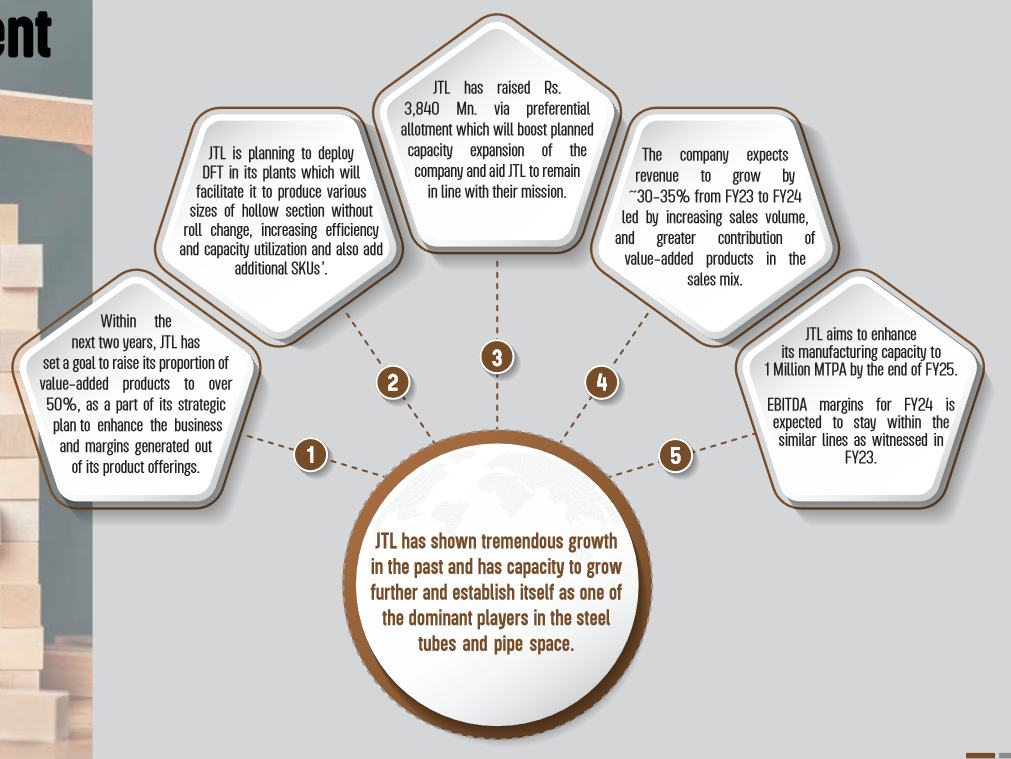

► Company is on the track to achieve a manufacturing capacity of 1 million tons by FY-25.

► Company incorporating additional DFT lines. DFT stands for Direct Forming Technology and it is an innovative route designed to produce steel tubes of different sizes. This tech reduces the time to design and manufacture the tubes of different sizes. It also reduces the cost of production.

► Introduction of new range of coloured products and backward integration in their facilities which will affect the margins positively in future.

Negatives:

► No significant negatives.

Management Guidance:

JTL Industries is a recognized Star Export House by the Government of India, JTL Industries is committed to delivering reliable, durable products worldwide for significant engineering and construction projects. The management has guided for the growth rate of 30-35% till the FY 2024, this is reinforced by the historical growth company has shown in the past years. This indicates the promise company holds that it will be able to grow at least at this rate even in future. Here is a snapshot of the management guidance for the future:

Challenges:

The company uses various raw materials with as steels as the major raw materials. The price and other industry variants in these commodities may affect the financial performance of the company in future. Also, any change in the government policy may significantly affect this industry as a whole.

The Multibagger takeaway:

JTL industries is well poised to capture the growth in various sectors such as construction, real estate, railways, manufacturing, solar and warehousing etc. All these sectors are also the sectors on which the government is focussing and helping these industries to grow with the policy support and various government initiatives such as the water infrastructure, solar and real estate development. Investors can study this as an opportunity to create wealth as these are the potential high growth sectors in India.

Disclaimer:

We are not a SEBI registered analyst, IndianMultibaggers will not be responsible for any loss in future. Please do your own research and consult your financial advisor before taking any investment decision. The prices and data may vary according to the market forces at the time of reading this article.

Research links:

https://www.bseindia.com/stock-share-price/jtl-industries-ltd/JTLIND/534600

https://www.nseindia.com/get-quotes/equity?symbol=JTLIND

https://www.screener.in/company/JTLIND/#quarters

https://www.jtl.one/wp-content/uploads/2024/01/Q3-Investor-presentation.pdf

https://www.blueweaveconsulting.com/report/india-steel-pipes-and-steel-tubes-market

https://www.dnv.com/software/campaigns-2023/synergi-pipeline-insights-report

https://premium.capitalmind.in/2020/08/a-deeper-look-at-the-indian-steel-pipe-industry

Follow us on twitter @medsmartsandy