IPO dates: 06-05-2024 to 08-05-2024

Price Band: 430.00-452.00 per share (Lot of 33 shares)

GMP: Rs 240 approx.

In the digital-led commercialization services and Life Science Industry, Indigene is a unique player with a virtual monopoly and steady growth in both its top and bottom lines. Based on FY24 annualized earnings, the issue looks fully and reasonably priced. The segments in which this company operates have bright future prospects, and investors may buy into it for the potential medium- to long-term rewards.

About the company:

For the life sciences sector, including biopharmaceutical, emerging biotech, and medical device companies, Indegene Ltd. (IL) offers digitally led commercialization services that help with drug development and clinical trials, regulatory submissions, pharmacovigilance and complaints management, and product sales and marketing. With the help of its solutions, life sciences businesses may create goods, introduce them to the market, and increase sales throughout their life cycles in a way that is more contemporary, effective, and efficient.

The business does this by fusing fit-for-purpose technology with more than 20 years of experience in the healthcare industry. All facets of the commercial, medical, regulatory, and R&D operations of life sciences enterprises are covered by its portfolio of solutions. With the combination of technology and healthcare, its solutions cover several phases of the pharmaceutical and medical device commercialization lifecycle. Enterprise Medical Solutions and Enterprise Clinical Solutions from IL serve the medical and R&D departments of life sciences enterprises, while Enterprise Commercial Solutions and Omni channel Activation solutions serve the commercial needs of these organizations. Emerging biotech businesses, manufacturers of medical devices, and biopharmaceutical corporations are among its clientele.

It employed 5181 people as of December 31, 2023, and has 65 active clients and with approximately 98% global revenue, the company is working in a unique industry and has carved out a position for itself in the verticals it serves. Over the next five years, it expects to grow at an average annual growth rate of 6.5%.

Details of IPO:

The firm is launching an offer for sale (OFS) of 23932732 shares, valued at Rs. 1081.76 cr. at the upper cap, together with its first combined IPO of fresh equity shares worth Rs. 760 cr. (about 16814160 shares at the upper cap). Therefore, the business is launching an IPO of 23,9249251 shares in order to raise Rs. 1841.76 cr. at the upper price range. A price range of Rs. 430 to Rs. 452 for each equity share worth Rs. 2 has been published by the corporation. Subscriptions for the issue will begin on May 06, 2024, and end on May 08, 2024. An application must be submitted for a minimum of 33 shares, and then in multiples of those shares.

For its qualified workers, the company has set aside about 276540 shares, valued at Rs. 12.50 cr., and is giving them a discount of Rs. 30 per share. It has set aside a maximum of 50% for QIBs, a minimum of 15% for HNIs, and a minimum of 35% for retail investors from the remaining amount. Kotak Mahindra Capital Co. Ltd., Citigroup Global Markets India Pvt. Ltd., J. P. Morgan India Pvt. Ltd., and land Nomura Financial Advisory and Securities (India) Pvt. Ltd. are the joint book running lead managers (BRLMs) for this issue. Link Intime India Pvt. Ltd. is the registrar.

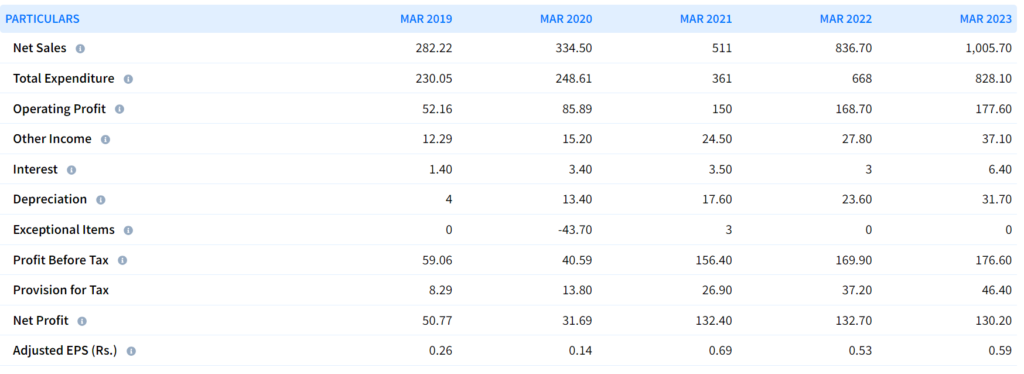

FINANCIAL DETAILS: SOURCE TICKER BY FINOLOGY

Our View: Apply for listing gains or as a long-term investment

As per India Today reports Anand Rathi Research recommended subscribing to the first public offering (IPO). The company provides global client service through strategically situated delivery centers and a global reach. This makes it possible for flexible collaboration, effective project management, and prompt service delivery across several geographies. With a post-issue market capitalization of Rs 1,081.4 crore, the firm is valued at a P/E of 40.6 times, according to Anand Rathi Research.

In addition, Swastika Investmart also advised to subscribe to this IPO, noting the company’s steady growth over the previous three fiscal years. “A strong client base of 65 active clients as of December 31, 2023, has supported the financial performance, which shows steady growth over the last three fiscal years. The organization has a strong portfolio of created technologies, which bolsters its digital capabilities. Even yet, the 37.79 times P/E valuation seems fair, according to Swastika Investmart.

With a distinct business strategy and a virtual monopoly in its industry, the corporation produces over 98% of its sales globally. Throughout the reporting periods, it showed consistent growth in both its top and bottom lines, and the segment is expected to have promising future growth.

Disclaimer:

All the details mentioned above have been collated from different reliable sources and these sources are backlinked for better clarification. You can study more about the details of the company in the Draft RHP submitted by company to the Securities and Exchange Board of India.