Company Overview: This company serves India’s infrastructural and industrial needs through Warehousing, Transportation, Equipment Rental, and Turnkey Infra-Project Execution. With 35+ years’ experience, we’re a top Steel Warehousing & Transport entity, handling 10M+ tons of Steel annually. Our fleet of 300 Machines includes Heavy Cranes (up to 800MT), Hydraulic Piling Rigs, Steel Processing, & Concrete Equipment.

Services and sectors: The Tara Chand InfraLogistic Solutions Ltd has contributed significantly to High-Speed Bullet Train and Metro Line projects across cities like Ahmedabad, Delhi, Mumbai, and more. They serve sectors like Steel, Cement, Oil & Gas, Renewable Energy, and Urban & Rural Infrastructure. We cater to 52 diverse customers, spanning PSUs to large Indian multinationals, operating in 21 states and even internationally in Mauritius. Our capable team of more than 700 engineers, operators & riggers, plus 300 contract workers, manage operations across 50+ live sites.

Key metrics: Let’s have a look at the main key metrics of the company:

|

Current Price |

Rs 440 |

|

Market Cap |

Rs 622 Cr |

|

PE |

38.6 |

|

PEG |

1.40 |

|

Debt to Equity |

0.90 |

|

Operating Profit Margin |

32.2% |

|

Book Value |

Rs 67.1 |

|

Promoter Shareholding |

73.3% |

|

DII Holding |

0.00% |

|

FII Holding |

0.00% |

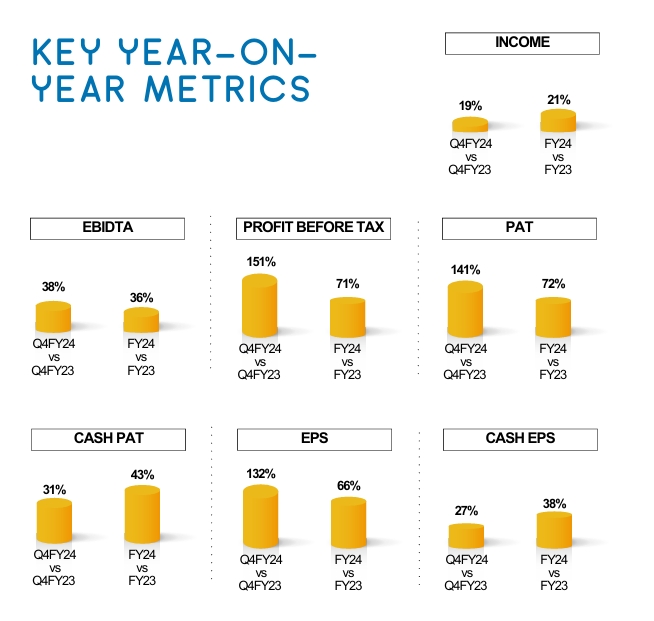

The company has reported the best ever quarterly results, let us have a look at the highlights:

F24 Financial Highlights:

► YoY Revenue growth :21%

► YoY EBIDTA growth :36%

► YoY PAT growth :72%

► YoY EPS growth :66%

Q4 Financial Highlights:

► QoQ revenue growth :19%

► QoQ EBIDTA growth :38%

► QoQ PAT growth :141%

► QoQ EPS growth :132%

Clients: They are a small cap player, yet they boast of strong client

network across India, let’s have a look:

Positives:

► Debtor days reduced from 143 to 112 days, indicating the improvement in the paying capacity of the company.

► Company has delivered good profit growth of 27.7% CAGR over last 5 years

► 3 Year Compounded profit growth rate of 73%

► EPS increased from 6.86(Mar 23) to 11.40 (Mar 24).

► Operating Profit Margin increased from 27% (Mar 23) to 32% (Mar24)

► Order book grew by 42% as it increased to 138.23 Cr (May 24) from 97.49 Cr (May 23)

► The Gross Block of the company is 298 Cr, with Net Block of 180 Cr, which indicated the strong asset book of

the company.

Negatives:

► 4% decrease in promoter holding (73% to 69%) in the last quarter.

Future Prospects: The strong financial performance of the company gospels well for the great future prospects of the company. The company has a niche position in many segments like it is the only private service in the company which provides RTG cranes. The long-term contracts of the company provides better visibility to the order book future. The company is also planning to enter in the energy sector in FY-25.

With a strong network across 21 states of India, they seem well poised to harness the strong tailwinds in the infrastructure sector. As India is doing a huge infrastructure spending, the company aims to continue capacity addition to meet the rising demand, especially for the industrial capacity expansion projects.

The Multibagger takeaway:

Tara Chand InfraLogistic Solutions Ltd’s commitment to sustained growth and nation-building is unwavering. As they continue to excel financially, they are also exploring new avenues to achieve our aggressive growth target of 30%. The company is also planning a Capex of Rs 150 Cr over the next two years to increase the company capabilities. The company is also looking to maintain and improve margins in future.

These initiatives will not only benefit shareholders but also contribute significantly to India’s infrastructure landscape. Investors can look to invest in these sorts of companies to get benefitted from India’s growth journey.

Disclaimer:

We are not a SEBI registered analyst, IndianMultibaggers will not be responsible for any loss in future. Please do your own research and consult your financial advisor before taking any investment decision. The prices and data may vary according to the market forces at the time of reading this article.