Company Overview:

Sanghvi Movers Ltd.a company is a largest crane rental company in India and Asia. and is sixth largest in world. The company has firmly established itself as a crucial player in India’s infrastructure sector. With a robust fleet of hydraulic and crawler cranes, the company serves a diverse range of industries, significantly contributing to the nation’s development. The company was founded in 1989 and is operational at 130+ job sites in India.

Services and Fleet:

Sanghvi Movers boasts an impressive array of cranes, ranging from medium to large-size hydraulic truck-mounted telescopic and lattice boom cranes, along with crawler cranes. The lifting capacities of these cranes span from 70 MT to 1000 MT, making them suitable for various heavy lifting needs across industries. This extensive fleet allows Sanghvi Movers to cater to a wide array of projects, from small-scale constructions to petrochemicals, wind energy, large infrastructure ventures. The company has diverse assets which includes crawler mounted cranes, Truck Mounted cranes.

Clients:

The company has a wide range of clients across the all sectors. The clients of the company includes:

Indian Oil Corporation, JSW, GRSE, Bharat Dalmia, Jindal Steel and Power, L&T, BHEL, Ambuja Cement, Ultratech Cement, Thermax, Adani Enterprises, Suzlon, Tata Steel etc.

Key Meterics:

- Current price: Rs 1165

- Stock PE: 26.9

- Debt to Equity: 0.29

- Book Value: Rs 234

- Profit Growth: 92%

- Cuurent Ratio: 1.81

- FII Holding; 2.49%

- DII Holding: 2.59

Technical Chart:

The price has corrected significantly from the high of Rs 1495 to Rs 1165 which near to the fibonacci retracement levels of 50%, which is around Rs 1052. Now the price is currently holding these levels and is now offering an opportunity to enter. Let us look at the chart:

Financial Performance:

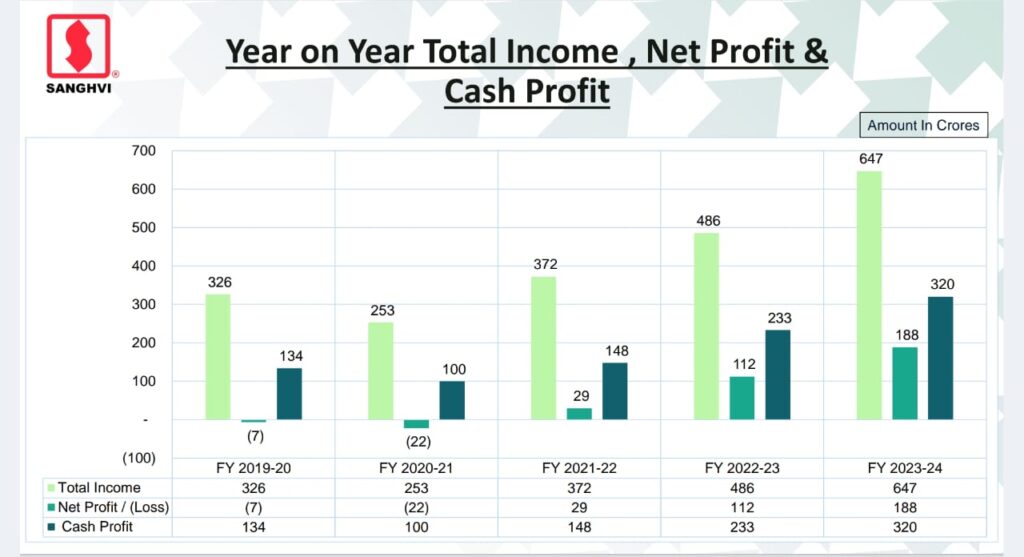

- Total Income has increased from Rs 486 cr to Rs 647 Cr.

- Net profit has increased from Rs 112 Cr to Rs 188 Cr..

- Cash Profit has increased from Rs 233 Cr to Rs 320 Cr.

Let us have a look at the snapshot of the year on year financial performance of the stock:

Order Book:

The company has a healthy order book and is also securing new orders. The company has worth of Rs 426 Cr orders, which are to be completed by FY-25. Let us have a look at the order book of the company:

Future prospects:

The Multibagger takeaway:

Index to links: